Anyone Can Leave a Legacy

A gift from your will or trust can have an impact for years to come. Your estate plan documents can indicate a gift to Kathy’s House for a specific dollar amount, a percentage of your estate, or the remainder after other wishes are fulfilled.

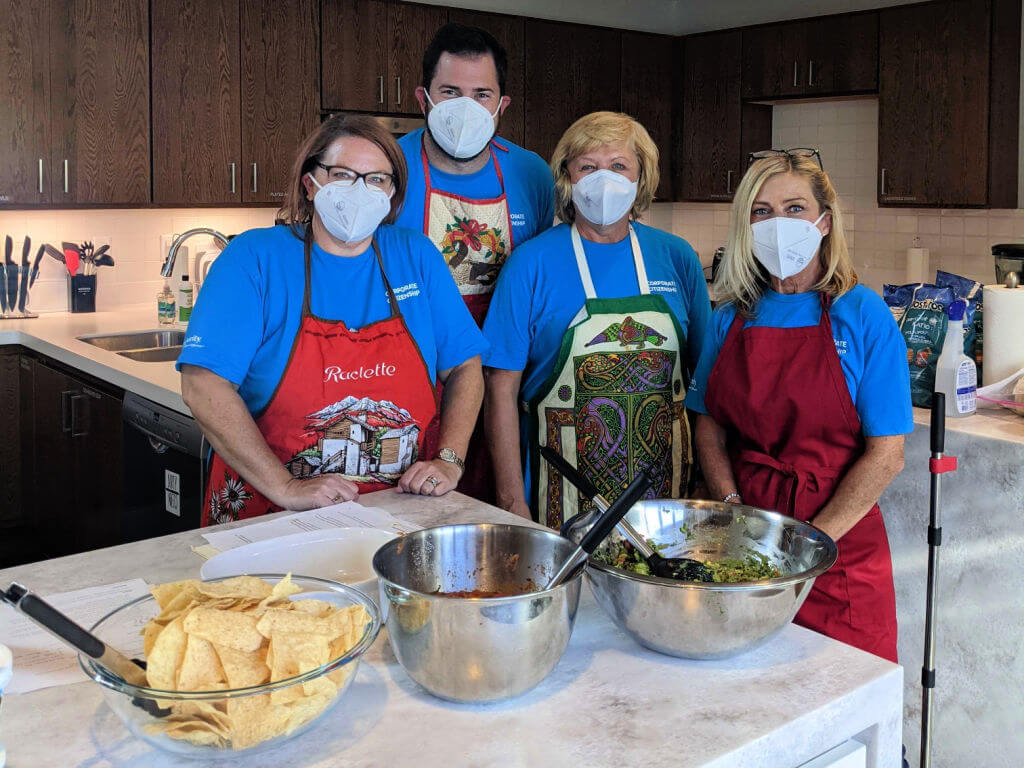

Dennis & Sheryl Cahn were inspired to give

When Dennis & Sheryl Cahn were completing their estate plan, they chose Kathy’s House as a beneficiary.

A subsequent tour inspired them to get more involved. As volunteers, they’ve been touched by the experience of the guests they serve. They can see firsthand the impact of a stay at Kathy’s House.

“I like being able to support this environment…being part of this welcoming unit, this family.”

– Sheryl Cahn

The Language of Legacy

Your attorney may find this sample bequest language useful. Our EIN is: 39-2022115

“I give ($___)(___% of my estate) to Kathy’s House, Inc., qualified as a charitable organization and a 501(c)(3) non-profit public benefit organization located at 9101 W. Doyne Ave, Milwaukee, WI 53226, (to be used in support of….).”

Click here for a Pledge Form to let Kathy’s House know of your wishes. You can take this form to your advisor, or complete it and send it to Kathy’s House.

Request More Information

Contact Katie Sparks with questions or information about giving from your will or trust.